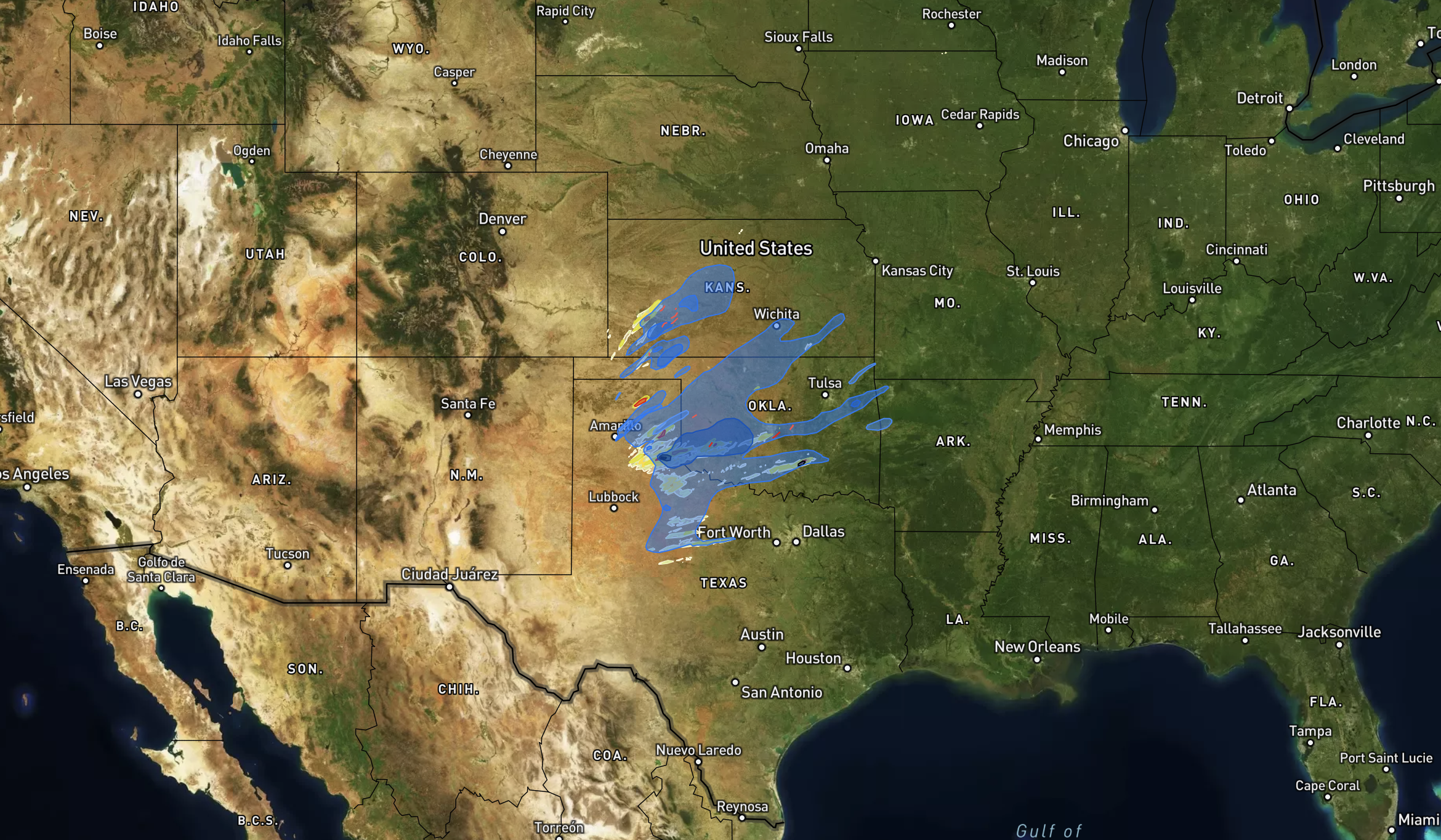

The night of February 26th, 2023 set a record for the most active tornadoes in the month of February in Oklahoma. Substantial derecho winds and tornado damage tore through Oklahoma and into Texas. A minimum of seven tornadoes were recorded to have touched town due to the storm, with the most damage hitting the Norman, Oklahoma area.

Even “small” tornadoes can inflict tremendous damage on a property – including visible damage to roofs, windows, and siding and less obvious damage like foundational cracks. Often the confusing twists and turns of tornado damage insurance claims lead policyholders to settle for less than they need to fully restore their property.

Property damage claims, specifically those with multiple damages present, can be overwhelming to deal with in the aftermath of a natural disaster. Insurance policies can be complicated, and the process of filing the claim, negotiating with your insurance company, and navigating the process can be stressful and time-consuming. That’s where a public adjuster comes in.

WHAT IS A PUBLIC ADJUSTER?

A public adjuster is a licensed professional who works on behalf of the policyholder to help them navigate the insurance claims process. They are experts in evaluating property damage and assessing the cost of repairs or replacement. They can also help policyholders understand their insurance policy and negotiate with the insurance company to ensure that they receive a fair settlement.

If you are a resident of Norman, Oklahoma, who has been impacted by the recent tornadoes, there are several reasons why you should consider hiring a public adjuster:

1. A public adjuster can help you get a fair settlement.

Insurance companies are in the business of making money, and sometimes they may try to minimize the amount they pay out on a claim. A public adjuster can help ensure that you receive a fair settlement that covers the full cost of repairing or replacing your damaged property.

2. A public adjuster can save you time and stress.

Dealing with the aftermath of a natural disaster can be overwhelming. Hiring a public adjuster can take some of the stress off your plate, as they can handle the claims process on your behalf. This allows you to focus on other important tasks, like repairing your property and getting your life back on track.

3. A public adjuster can help you avoid common mistakes

Insurance policies can be complicated and it is easy to make mistakes when filing a claim. A public adjuster can help you avoid common mistakes that often lead to denied or underpaid claims. When choosing a public adjusting firm to work with, be sure you do your due diligence and be sure they are qualified to represent you on your loss.

WHY CHOOSE C3 GROUP?

Our team is comprised of an incomparable investigations team of certified Level 3 Xactimate estimators, and Public Adjusters that have experience handling some of the most complex insurance claims. Each member of our team is committed to putting people first, making sure every question is answered, and an open line of communication is in place throughout the process. We value transparency to ensure all of our clients know exactly what to expect and are involved in any decisions or issues that may arise. Our team prides itself on producing a proven work product that relies on our fanatical attention to detail and data-driven results. This allows our work product to speak for itself, eliminating many carrier arguments from the beginning of the claim process to a quick and accurate settlement.

Policyholders should not have to just settle when it comes to their property damage insurance claims. We believe they should Settle For Better.

If you have questions about your insurance claim we are always here to help!

WHAT SHOULD I DO WHEN MY

PROPERTY IS DAMAGED BY A TORNADO?

-

- Making claim for replacement cost value (RCV)

- “Suit Against Us” provisions

- Proof of Loss

-

- Statutory requirements

- Business interruption/extra expense

-

- A need for engineers

- Short inspections

- Mentions of damages under deductible

-

- Reservations of Rights

- Claim denials or delays

- Examination under oath (EUOs)

COMMON QUESTIONS ABOUT TORNADO DAMAGE INSURANCE CLAIMS

Understand the important things to consider and get answers to your top questions about your tornado damage property claim.

How do I know if I should turn in a tornado damage claim?

It’s best to contact a professional to validate damages BEFORE you notify your insurance company in order to avoid a frivolous claim. There are no hard and fast rules on what warrants damage. For example even 1″ hail and 60 mph gusts can cause damage depending the surface it impacts. (Watch this video for an example.)

Will a tornado claim raise my premiums?

Typically an “act of god” claim will not increase your premium. However, even if you don’t submit a claim or are not affected by a large catastrophic storm, you may see a rate increase as many other people submit claims.

Can I dispute my tornado claim?

Who do you trust, your contractor or your insurance adjuster? If you have an active claim and you have a large dispute between the amount paid by insurance and what your contractor is stating, it’s a good idea to contact a public adjuster, who can assist you in disputing the claim.

What do I do if my claim gets denied or underpaid?

If you have a claim denial or a partially denied claim, it is a good idea to have a licensed public adjuster or attorney review the file to provide a secondary coverage opinion. Our team can review your claim for free.

How do I know if I need a public adjuster on my tornado damange claim?

A qualified restoration contractor can provide an estimate and guide you through the residential claims process. However, if you own or manage a commercial property, policies become more complex and require more detailed reviews of coverage. Oftentimes, insurance companies will require detailed estimates written in a software program, Xactimate. And unfortunately, the vast majority of commercial property claims are underpaid. Our team is certified in Xactimate and includes one of only 48 Xactimate Certified Trainers in the nation. We also have the insurance knowledge and industry expertise you need to ensure your claim is filed accurately, negotiated professionally and paid fairly.

What if my insurance company doesn't pay Overhead and Profit on my tornado claim?

This is a common problem with some insurance companies and it’s unfair and in some states – illegal. Overhead and profit, (“O & P”) is a known expense that all contractors charge, usually at a rate of 10% and 10%. Sometimes insurers will not pay this on the roofing portion of the claim because they believe it’s already part of the Xactimate estimate. Check out our white paper to learn why this is incorrect.

As a contractor, why should I engage a public adjuster on a tornado claim?

A public adjuster can help with scaling your company by taking out the everyday minutia of writing an estimate, corresponding with stakeholders and insurance company reps and navigating policy intricacies. We also have the training and expertise to handle claim red flags on behalf of you and your customer, including when/if to engage an engineer, policy coverage, delays, unwarranted denials or underpayment. Furthermore, there are legal limits to what a contractor can do when dealing with insurance claims. Contractors working with policyholders should check the public adjuster statutes in their jurisdiction to ensure they are not acting as an unlicensed public adjuster when assisting in claims.