Florida Governor Ron DeSantis is expected to sign Florida SB 122/HB 7065 into law on July 1, 2019, which was created to stop the abuse of AOB’s in first-party insurance claims. These changes will impact roofers, contractors and other first-party insurance claim service providers across the state. Here’s what you need to know:

Changes To AOB’s Made by SB 122/HB 7065

Changes to the law will only apply to policies issued after July 1, 2019. While SB 122/HB 7065 doesn’t prevent AOB’s from being used, assignment contracts must meet the following conditions:

- Allow the insured/assignor of claim to rescind the AOB within a set timeframe (14 days)

- The AOB contract must be sent to the insurer within 3 business days after it is signed, or work starts (whichever comes first)

- Once an AOB is signed, work must start within 30 days

- The AOB must contain an itemized, detailed estimate of work/services/repairs

- Emergency services performed under an AOB cannot exceed $3,000 or 1% of the coverage under the policy (whichever is greater)

Additional Requirements Include:

- If the assignee decides to litigate the claim, they must provide written intent to the insurance company. Insurance carriers then have up to 10 days to make a pre-suit offer or request appraisal.

- The “one-way fee provision” under the existing Florida Statue will be removed – meaning attorney’s fees will be restricted, even on cases that are won

Impacts Of SB 122/HB 7065 On Roofing Contractors

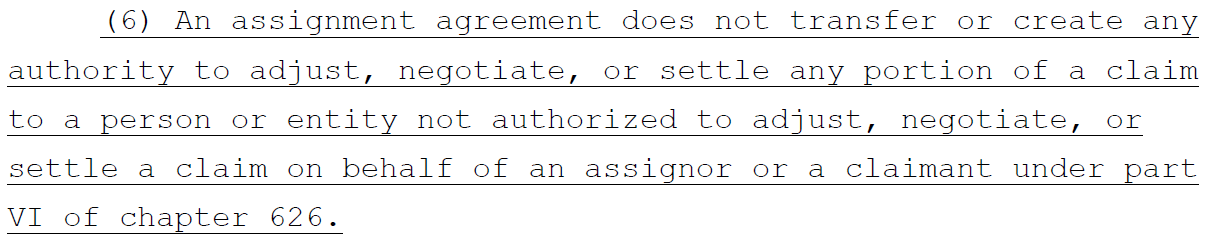

In states like Florida where UPPA laws are a felony, AOB/AOC type of agreements have allowed contractors to discuss claim scope and price with insurance companies without technically breaking the law. SB 122/HB 7065 will change that. Section 6 clearly states that contractors cannot adjust the claim in any capacity. Contractors who have been using AOB’s to control the claim outcome will no longer be able to do so.

Going forward, contracts that transfer ANY rights from a policyholder to a third party should be reviewed by a contract attorney to prevent accidental or unintentional violation of the new law. Using a PA/attorney is now a necessity if you have claim disputes (or utilizing appraisal in a similar regard).

The good news for contractors is that there is still nothing wrong with having a standard direction-to-pay and contingency agreement that DOES NOT have a limited POA or AOB attached to it. Those provide similar protections, without the need for an AOB.

Have questions or need more information? Contact us today or join the conversation on Facebook or LinkedIn.