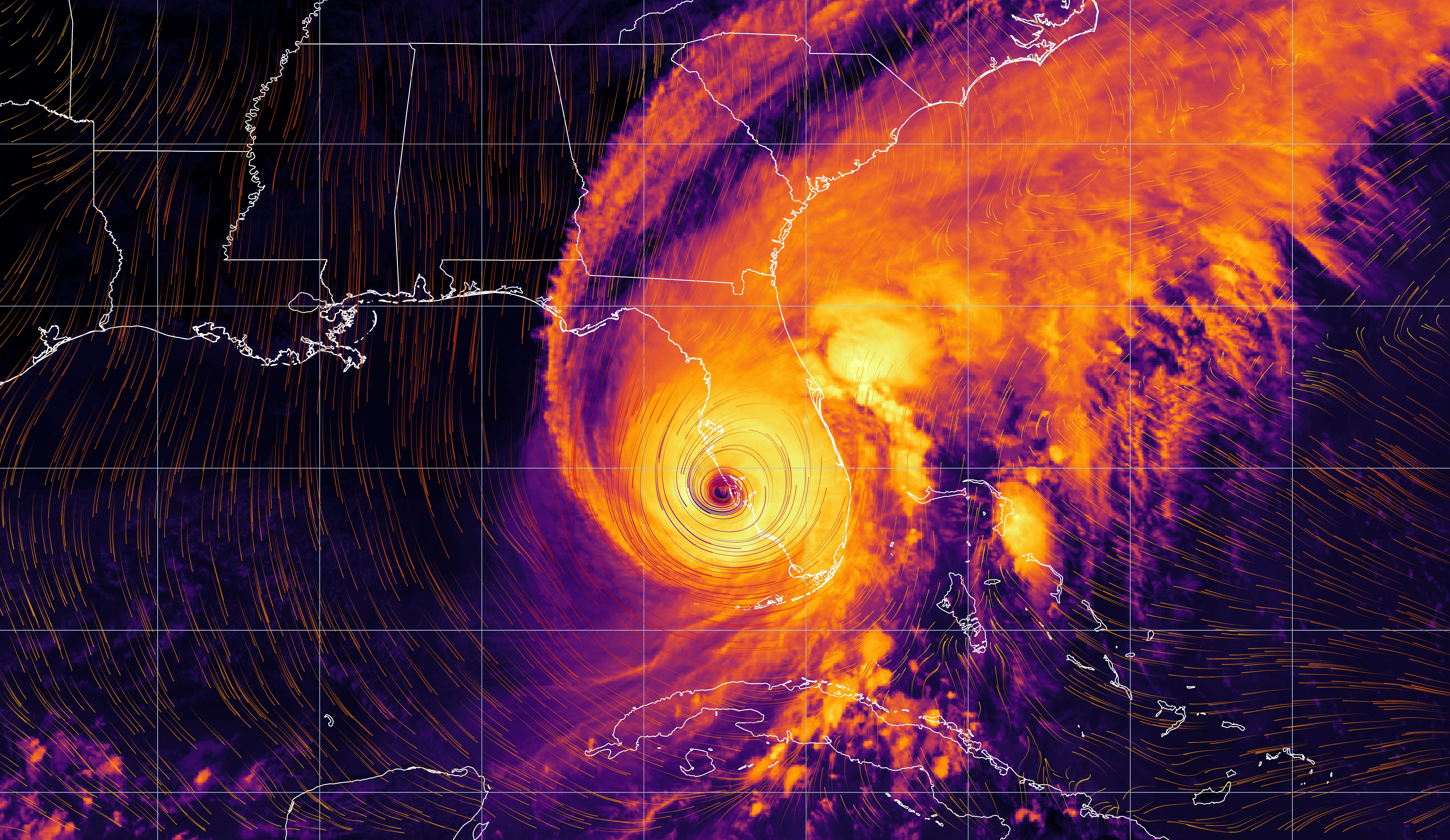

HURRICANE IAN IS PROJECTED TO BE ONE OF THE MOST COSTLY STORMS WE HAVE EVER SEEN.

On September 28th, 2022 Hurricane Ian landed on the southwest shores of Florida causing catastrophic property damage. Some of the cities include (but are not limited to):

- Arcadia

- Boca Grande

- Bokeelia

- Bonita Springs

- Bradenton

- Cape Coral

- Captiva

- Clearwater

- Englewood

- Estero

- Fort Myers

- Fort Myers Beach

- Largo

- Longboat Key

- Marco Island

- Naples

- Nokomis

- North Port

- Osprey

- Placida

- Port Charlotte

- Punta Gorda

- Sanibel

- Sarasota

- Siesta Key

- St. Petersburg

- Tampa

- Vamo

- Venice

.

Damage to this extent means your insurance company is inundated with calls and claims that can slow the path to recovery. Our team of public adjusters and experts are here as a resource to advocate for you, investigate and document the damage to its full extent, and negotiate every important detail of your loss. We want to help you recover from your loss and make sure you have what you need to do so.

WE GET PAID WHEN YOU GET PAID

C3 Group works on a contingency basis, meaning if we do not recover additional insurance proceeds, you pay us nothing. Therefore, we are vested in resolving your claim ethically, properly, and promptly.

The insurance company has claim adjusters working for them. It’s imperative to have someone representing your interests as well. C3 Group welcomes the opportunity to review your claim as a courtesy at no cost to you.

WHAT IS A PUBLIC ADJUSTER?

A public adjuster is a licensed professional who works on behalf of the policyholder to help them navigate the insurance claims process. They are experts in evaluating property damage and assessing the cost of repairs or replacement. They can also help policyholders understand their insurance policy and negotiate with the insurance company to ensure that they receive a fair settlement.

If you are a resident of Norman, Oklahoma, who has been impacted by the recent tornadoes, there are several reasons why you should consider hiring a public adjuster:

1. A public adjuster can help you get a fair settlement.

Insurance companies are in the business of making money, and sometimes they may try to minimize the amount they pay out on a claim. A public adjuster can help ensure that you receive a fair settlement that covers the full cost of repairing or replacing your damaged property.

2. A public adjuster can save you time and stress.

Dealing with the aftermath of a natural disaster can be overwhelming. Hiring a public adjuster can take some of the stress off your plate, as they can handle the claims process on your behalf. This allows you to focus on other important tasks, like repairing your property and getting your life back on track.

3. A public adjuster can help you avoid common mistakes

Insurance policies can be complicated and it is easy to make mistakes when filing a claim. A public adjuster can help you avoid common mistakes that often lead to denied or underpaid claims. When choosing a public adjusting firm to work with, be sure you do your due diligence and be sure they are qualified to represent you on your loss.

WHY CHOOSE C3 GROUP?

Our team is comprised of an incomparable investigations team of certified Level 3 Xactimate estimators, and Public Adjusters that have experience handling some of the most complex insurance claims. Each member of our team is committed to putting people first, making sure every question is answered, and an open line of communication is in place throughout the process. We value transparency to ensure all of our clients know exactly what to expect and are involved in any decisions or issues that may arise. Our team prides itself on producing a proven work product that relies on our fanatical attention to detail and data-driven results. This allows our work product to speak for itself, eliminating many carrier arguments from the beginning of the claim process to a quick and accurate settlement.

Policyholders should not have to just settle when it comes to their property damage insurance claims. We believe they should Settle For Better.

If you have questions about your Hurricane Ian insurance claim we are here to help!

What should i do if a hurricane

damages my property?

-

- Making claim for replacement cost value (RCV)

- “Suit Against Us” provisions

- Proof of Loss

-

- Statutory requirements

- Business interruption/extra expense

-

- A need for engineers

- Short inspections

- Mentions of damages under deductible

-

- Reservations of Rights

- Claim denials or delays

- Examination under oath (EUOs)

Common questions about

hurricane insurance claims

How can I mitigate damages to my property without exceeding my policy limits?

Roof tarping is a commonly accepted temporary repair. “Loose lay” is a term some mitigation contractors are using to reference brand new membrane roof material laid loosely on the roof and secured with rocks. While this may work, it’s extremely expensive and it could burn through your policy limits while not even providing a permanent solution. Another term is “shrink wrapping” where again, the fix can cost more than the actual repair, diminishing your policy limits.

How can I tell if my tile roof is damaged or not?

Tile roofs can appear unscathed after a storm but wind uplift tests can provide evidence unseen to the naked eye. Wind can cause the tiles to jiggle up and down or “chatter.” Even though the tiles themselves look fine, their repetitive movement can put small tears and punctures in the underlayment and loosen the fasteners, reducing the ability of the tile to resist future uplift events and remain water tight. Consider hiring a public adjuster or damage expert to perform the appropriate tests.

Why can’t a new roof fastener be placed in the same hole as the original fastener?

There are several reasons for this. First, the new fastener will not have the same holding capacity as the original fastener. Water tightness of the underlayment will be compromised where the original fastener was placed. Sealing the fastener hole is not putting the roof back into the position it was prior to the damage occurring. Lastly, installing a larger diameter fastener may not be possible without modifying the tile, which would invalidate the Florida Product Approval.

When and why would a structural engineer be needed for hurricane property damage?

The high wind blowing over the roof creates a low pressure in accordance with Bernoulli’s principle. This difference of pressure causes an upward thrust and the roof is lifted up. This is why C3 Group recommends that a licensed structural engineer inspect properties to determine if the pressure build up caused more severe damage than meets the eye. The insurance company may provide one of their choice. However, if you have professional fees coverage under your policy, you may be able to use this additional coverage toward hiring one of your choice. Make sure they are a licensed STRUCTURAL engineer (not forensic).

How do I know if a hurricane/wind damaged my windows?

The answer to whether or not wind can affect the performance of a window can be complicated and a proper inspection is essential. Furthermore, the effect of wind forces needs to be considered in context with other factors, such as window maintenance, material properties and possible issues in the original manufacturing. Consider hiring a public adjuster or damage expert to obtain the correct inspections.

How can I be sure my property is safe to occupy again after hurricane damage?

At C3 Group, we hire expert industrial hygienists on every water and fire-related loss to inspect, assess and resolve any health and safety issues.

Can I dispute my hurricane claim?

Who do you trust, your contractor or your insurance adjuster? If you have an active claim and you have a large dispute between the amount paid by insurance and what your contractor is stating, it’s a good idea to contact a public adjuster, who can assist you in disputing the claim.

What do I do if my claim gets denied or underpaid?

If you have a claim denial or a partially denied claim, it is a good idea to have a licensed public adjuster or attorney review the file to provide a secondary coverage opinion. Our team can review your claim for free.

How do I know if I need a public adjuster on my hurricane claim?

A qualified restoration contractor can provide an estimate and guide you through the residential claims process. However, if you own or manage a commercial property, policies become more complex and require more detailed reviews of coverage. Oftentimes, insurance companies will require detailed estimates written in a software program, Xactimate. And unfortunately, the vast majority of commercial property claims are underpaid. Our team is certified in Xactimate and includes one of only 48 Xactimate Certified Trainers in the nation. We also have the insurance knowledge and industry expertise you need to ensure your claim is filed accurately, negotiated professionally and paid fairly.