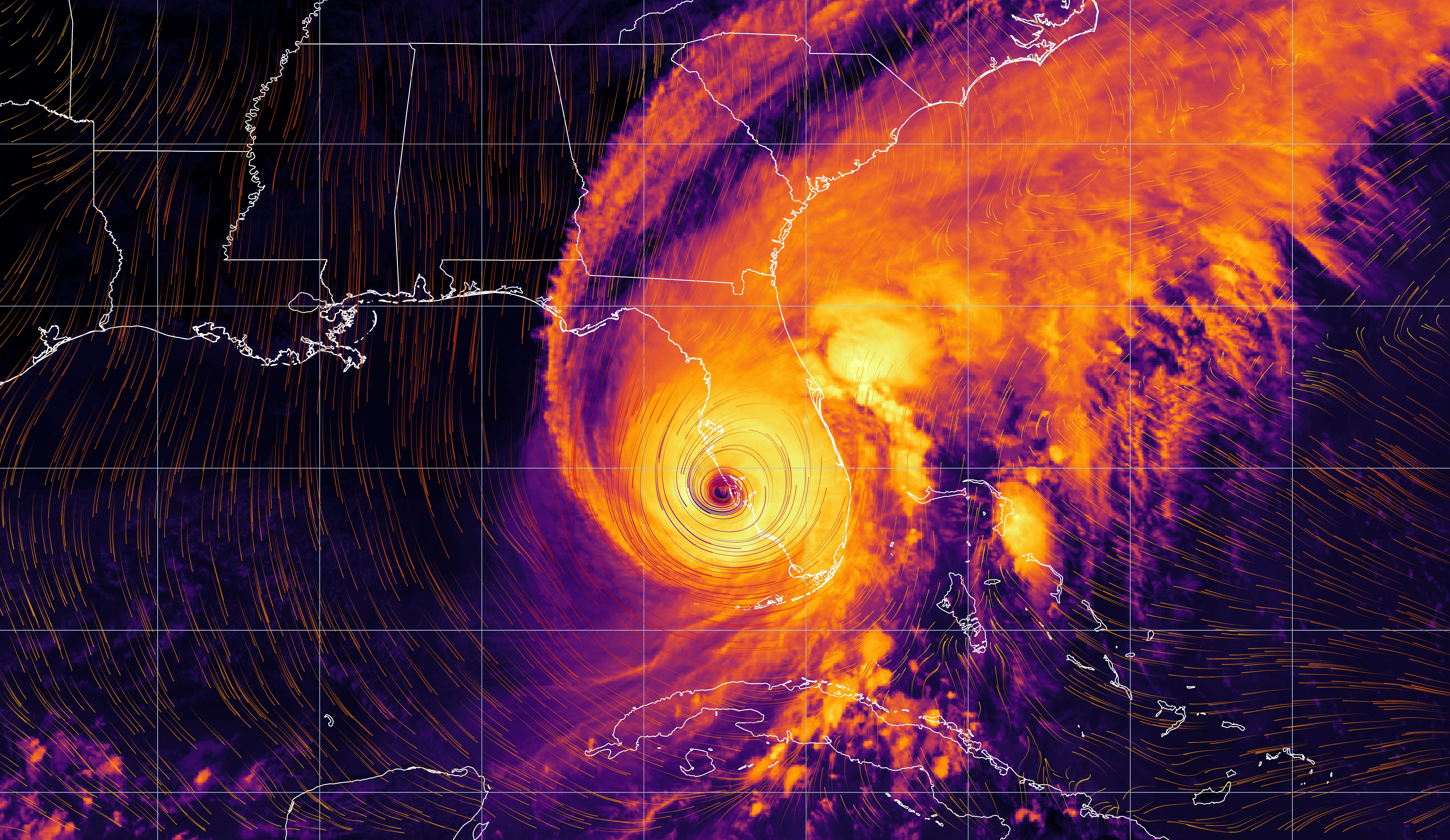

Hurricane Ian struck the southwest coast of Florida six months ago, on September 28, 2022. According to a National Hurricane Center report, more than $109 billion in damages officially ranks Ian as the most costly hurricane to hit Florida. Following widespread devastation of this magnitude, many affected areas still struggle to resume a sense of normalcy that may be further away than necessary.

As of today, the Florida Office of Insurance Regulation has estimated that only 41.7% of the reported commercial property damage claims have been closed. Of those commercial claims, 8,517 have been closed without payment, and 13,782 remain open without payment. These claim numbers don’t even begin to address the business interruption, loss of use, or other policy coverages afforded to business owners through their policies.

Why are so many claims being underpaid?

Many of the damaged properties and claims our team has encountered so far have significantly more damage than what has been estimated. We are seeing properties that may have been built and/or repaired with the newer code requirements, and the claims are being passed off as “not that bad” compared to those around them, or the older properties are being denied and underpaid, leaving the policyholder unable to rebuild.

What now?

There are many options available to ensure an appropriate settlement. If your claim is still unpaid, underpaid, or denied, there is still time to get a second opinion or receive help navigating the process. Even for those whose insurance providers are becoming insolvent, ensure you get all the information before giving up on your claim. It is not too late, but time is of the essence.

If you are interested in receiving a review of your Hurricane Ian property claim, our team will be happy to provide you with a free claim evaluation and discuss your available options to move forward.